You filed your insurance claim expecting fair compensation for your injuries. Instead, you received a denial letter. This scenario plays out constantly across California, insurance companies routinely reject valid claims hoping policyholders will simply accept the decision and move on. Working with a denied insurance claim lawyer can help you push back against these tactics and recover the money you’re owed.

At Steven M. Sweat, Personal Injury Lawyers, APC, we’ve spent over 25 years representing California accident victims whose claims have been wrongfully denied, delayed, or undervalued. We’ve seen insurers use every excuse in the book to avoid paying legitimate claims, from questioning the severity of injuries to blaming pre-existing conditions. The good news? You have legal options to fight back.

This guide breaks down the California insurance appeal process from start to finish. You’ll learn the most common reasons claims get denied, how to gather evidence for a successful appeal, when bringing in an attorney makes sense, and what happens if your dispute ends up in court. If you’re staring at a denial letter right now, the path forward starts here.

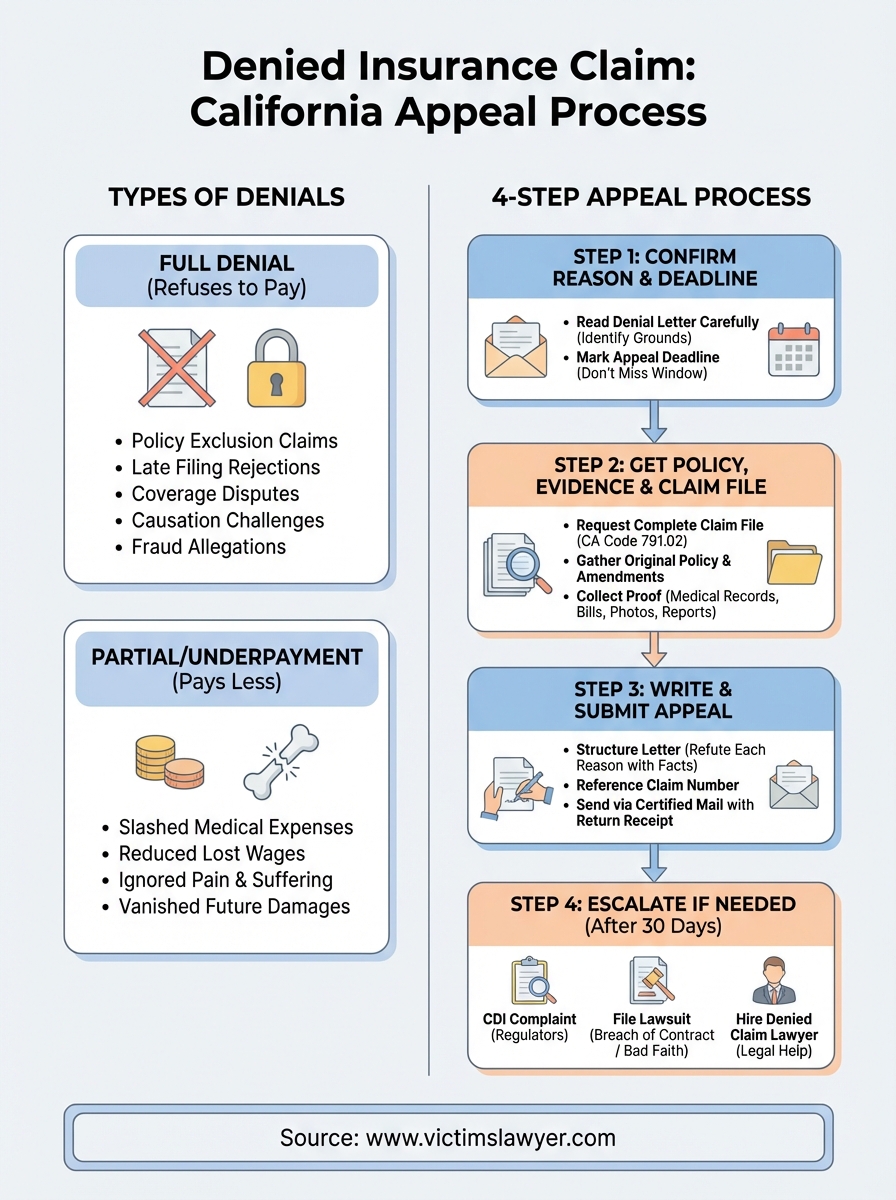

What counts as a denied or underpaid claim

Your insurance company can reject your claim in several ways, and each scenario requires a different response strategy. A denied claim means the insurer refuses to pay anything at all, citing policy exclusions, late filing, or insufficient evidence. An underpaid claim happens when they send you a settlement check but the amount falls far short of your actual losses. Both situations give you legal grounds to appeal in California.

Full denials

Insurance companies issue outright denials when they claim your situation doesn’t qualify for coverage under your policy terms. These denials typically come with a formal letter explaining their reasoning, though the explanations often rely on technical language designed to discourage you from challenging the decision. Common denial scenarios include:

- Policy exclusion claims: The insurer argues your injury or damage falls under a specific policy exclusion, such as pre-existing conditions or intentional acts

- Late filing rejections: They claim you missed the deadline to report the accident or submit your claim paperwork

- Coverage disputes: The company denies that you had active coverage on the date of the incident

- Causation challenges: They argue your injuries weren’t caused by the accident you reported

- Fraud allegations: The insurer accuses you of providing false information or exaggerating your injuries

Insurance companies count on the fact that most policyholders will accept a denial without fighting back, even when the decision violates California insurance law.

Partial denials and underpayments

Many California insurers approve claims in principle but drastically reduce the payout amount, hoping you’ll accept less than you deserve. Partial denials can be harder to spot than full rejections because you’re receiving some compensation. Your claim falls into this category when:

- Medical expenses get slashed: The insurer only covers a fraction of your treatment costs, claiming certain procedures weren’t medically necessary

- Lost wages calculations shrink: They dispute your income level or argue you could have returned to work sooner

- Pain and suffering disappears: The settlement check only addresses medical bills and ignores your physical pain, emotional distress, and reduced quality of life

- Future damages vanish: The insurer refuses to account for ongoing treatment needs or permanent disability

Working with a denied insurance claim lawyer becomes particularly valuable in underpayment situations because insurers count on you not knowing the true value of your claim. You might think $15,000 sounds reasonable until an attorney reviews your case and determines it’s actually worth $150,000.

Delayed claims

California insurance law requires carriers to respond to claims promptly, but many deliberately stall the process hoping you’ll give up or accept a lowball offer out of financial desperation. A delay becomes actionable when your insurer:

- Takes more than 40 days to accept or deny your claim after receiving all required documentation

- Repeatedly requests the same information you’ve already submitted

- Fails to explain what additional evidence they need to make a decision

- Stops responding to your calls and emails entirely

These delays violate California’s unfair claims practices regulations, and you can include them as part of your appeal or eventual bad faith lawsuit. Document every instance of unnecessary delay because this pattern of behavior strengthens your case for additional damages beyond the original claim amount.

Step 1. Confirm the reason and your deadlines

Your first move after receiving a denial involves reading the entire denial letter carefully and marking your appeal deadline on a calendar. Insurance companies structure these letters to discourage appeals, burying the real reasons deep in legal language or failing to explain their decision at all. You need to identify the specific grounds for denial before you can build a strong counter-argument, and missing your deadline will kill your appeal before it starts.

Read the denial letter carefully

Every denial letter from a California insurer must include specific information under state law, though many companies provide vague or incomplete explanations hoping you won’t notice. Your denial letter should clearly state:

- The exact policy provision the insurer claims excludes your claim

- The factual basis for their decision (what evidence led to the denial)

- Your right to appeal and the process for doing so

- The deadline by which you must submit your appeal

- Contact information for the claims adjuster handling your case

If your letter lacks any of these elements, the insurer has violated California Insurance Code Section 10123.15, and you can use that violation to strengthen your appeal. Take notes on everything the letter says and everything it fails to explain. Circle or highlight the stated reason for denial because this becomes the target you’ll address in your appeal.

California law requires insurers to provide clear, specific reasons for claim denials, not vague references to policy language or unsubstantiated conclusions about your injuries.

Calculate your appeal deadline

California gives you specific timeframes to challenge a denial, and these deadlines vary depending on your insurance type and policy terms. Most health insurance appeals must start within 180 days of the denial date, while property and casualty claims typically allow 60 days for an internal appeal. Your policy documents control the exact deadline, so check both the denial letter and your policy.

Count the days from when you received the denial letter, not when the insurer mailed it. Add this deadline to your phone calendar with reminders starting two weeks before the date. Missing the appeal window typically forfeits your right to challenge the decision internally, forcing you straight to court or arbitration where having a denied insurance claim lawyer becomes necessary. Start gathering your evidence immediately because rushing an appeal at the last minute gives the insurer ammunition to deny you again.

Step 2. Get your policy, evidence, and claim file

Building a successful appeal requires complete documentation of both what your insurer promised and what actually happened to you. California law gives you the right to access your entire claim file, including internal notes and communications your adjuster never shared with you. You need three categories of documents before writing your appeal: your insurance policy, your claim file from the insurer, and evidence proving your losses.

Request your complete claim file

Under California Insurance Code Section 791.02, you have the legal right to review everything your insurance company collected about your claim. This includes adjuster notes, medical record reviews, surveillance reports, and internal emails discussing your case. Send a written request to your insurer asking for:

- All documents, notes, and correspondence related to your claim

- Any medical or expert reports they obtained

- Recorded statements you or witnesses provided

- Photos or videos they collected from the accident scene

- Internal communications about your claim decision

Use this template to request your file:

[Your Name]

[Your Address]

[City, State ZIP]

[Date]

[Insurance Company Name]

Claims Department

[Address]

Re: Request for Complete Claim File

Claim Number: [Your Claim Number]

Policy Number: [Your Policy Number]

Dear Claims Manager,

Under California Insurance Code Section 791.02, I request a complete copy of my claim file, including all documents, correspondence, notes, reports, photographs, recordings, and internal communications related to the above claim.

Please provide these materials within 30 days to the address above.

Sincerely,

[Your Signature]

[Your Printed Name]

Most insurers must respond within 30 days of receiving your request. Their file often reveals the real reasons behind your denial that didn’t appear in the denial letter.

Gather your policy documents

Pull out your original insurance policy and any amendments or endorsements you’ve received. You need these documents to verify what coverage you actually purchased and whether the insurer’s interpretation matches the policy language. Many working with a denied insurance claim lawyer discover their policy actually covers situations the insurer claimed were excluded.

Collect evidence that supports your claim

Your appeal needs concrete proof of your injuries, damages, and how the accident caused them. Strong evidence includes:

- Medical records, bills, and treatment plans from all providers

- Wage statements and employment records showing lost income

- Photographs of your injuries and property damage

- Witness statements describing the accident

- Police or incident reports

- Expert opinions on causation or future treatment needs

California courts recognize that insurers control most claim evidence during the initial review, so collecting your own documentation strengthens your position if the appeal fails and you need to file a lawsuit.

Organize everything chronologically and make copies before submitting anything to the insurer. You’ll reference these materials throughout the appeal process.

Step 3. Write and submit a California appeal

Your appeal letter needs to directly address the denial reason the insurer provided while presenting evidence that contradicts their decision. California insurers must reconsider claims when you provide new information or demonstrate they misinterpreted your policy or the facts of your case. Write your appeal in clear, factual language that focuses on specific policy provisions and concrete evidence rather than emotional arguments about fairness.

Structure your appeal letter

Start your appeal by referencing your claim number and the denial date to ensure the insurer routes your letter to the correct adjuster. Your opening paragraph should state that you’re appealing the denial and briefly summarize why their decision was wrong. The body of your letter needs to systematically refute each reason the insurer gave for denying your claim.

Use this template structure:

[Your Name]

[Your Address]

[City, State ZIP]

[Date]

[Insurance Company Name]

Appeals Department

[Address]

Re: Appeal of Claim Denial

Claim Number: [Number]

Policy Number: [Number]

Date of Denial: [Date]

Dear Appeals Manager,

I am appealing your denial of my claim dated [date]. Your letter stated

[specific reason for denial], but this decision misinterprets both my

policy and the facts of my case.

[Paragraph addressing each denial reason with specific evidence]

My policy states [quote relevant policy language]. The evidence shows

[specific facts proving coverage applies]. I have attached [list

documents] that demonstrate [what they prove].

I request you reverse your denial and pay the full amount of my claim.

Please respond within 30 days as required by California law.

Sincerely,

[Your Signature]

[Your Printed Name]

Insurers frequently deny valid claims hoping you won’t appeal, but California law requires them to reconsider when you present evidence they overlooked or misinterpreted.

Submit your appeal properly

Send your appeal via certified mail with return receipt to create proof the insurer received it before your deadline. Keep copies of everything you submit because you’ll need this documentation if you later hire a denied insurance claim lawyer to file a lawsuit. Include all supporting evidence as attachments and reference each document in your letter so the reviewer knows what you’re providing.

Mail your appeal to the specific address listed in your denial letter, which may differ from the general claims department address. Track your certified mail receipt and follow up with a phone call after the insurer signs for delivery.

Step 4. Escalate outside the insurer if needed

Your insurer has 30 days to respond to your internal appeal under California law. If they deny your appeal or ignore your deadline, you need to escalate your dispute to external authorities or the court system. California provides multiple pathways to challenge unfair claim denials, from filing complaints with state regulators to filing lawsuits for breach of contract and bad faith. The route you choose depends on your claim value, the insurer’s behavior, and how much evidence you’ve gathered.

File a complaint with California Department of Insurance

The California Department of Insurance (CDI) investigates complaints against insurers who violate state regulations or engage in unfair claims practices. Filing a complaint costs nothing and often pressures insurers to reconsider because the department can impose fines and sanctions against companies with patterns of wrongful denials. Submit your complaint online at the CDI website or mail it to their Consumer Services Division.

Your complaint should include specific details about your claim number, the denial reasons, and how the insurer violated California law. Attach copies of your denial letter, appeal, policy pages, and any evidence the insurer ignored. The department typically responds within 30 to 45 days and may require the insurer to reconsider your claim or explain their decision in detail.

California regulators investigate thousands of insurance complaints annually, and many result in reversed denials or increased settlement offers once the department gets involved.

Consider filing a lawsuit

When your claim value exceeds a few thousand dollars and the insurer continues denying coverage despite clear policy language in your favor, filing a breach of contract lawsuit becomes necessary. California courts can award you the full claim amount plus interest, attorney fees, and penalties if you prove the insurer wrongfully denied coverage. You’ll need to file within the statute of limitations, typically two years from the denial date for breach of contract claims.

Lawsuits become particularly valuable when the insurer’s conduct crosses into bad faith territory. If they knowingly denied a valid claim, failed to investigate properly, or used deceptive tactics during the claims process, California law allows you to recover additional damages beyond your policy limits. These bad faith damages can include emotional distress compensation and punitive damages designed to punish the insurer’s misconduct.

When to hire a denied insurance claim lawyer

Bringing in a denied insurance claim lawyer makes sense when your internal appeal fails and your claim involves substantial damages or complex legal issues. Attorneys who specialize in insurance disputes know how to document bad faith conduct, file complaints with regulators, and litigate cases through trial if needed. Most personal injury lawyers work on contingency, meaning you pay nothing upfront and they only collect fees if they recover money for you.

Next steps

Fighting a wrongful claim denial takes persistence and documentation, but California law gives you powerful tools to challenge insurers who refuse to pay what they owe. Start your appeal immediately after receiving a denial because deadlines pass quickly and missing them can cost you everything. Follow each step in order: confirm your reason and deadline, gather all policy documents and evidence, submit a detailed written appeal, and escalate to regulators or court if the insurer continues denying coverage.

Your claim becomes stronger when you work with a denied insurance claim lawyer who understands California insurance regulations and knows how to document bad faith conduct. If your appeal fails or involves substantial damages, legal representation shifts the balance in your favor because insurers take cases more seriously when attorneys get involved. Contact Steven M. Sweat, Personal Injury Lawyers, APC for a free consultation to review your denial and determine the best path forward. We’ve recovered hundreds of millions for California accident victims over 25 years, and we work on contingency so you pay nothing unless we win your case.

California Accident Attorneys Blog

California Accident Attorneys Blog